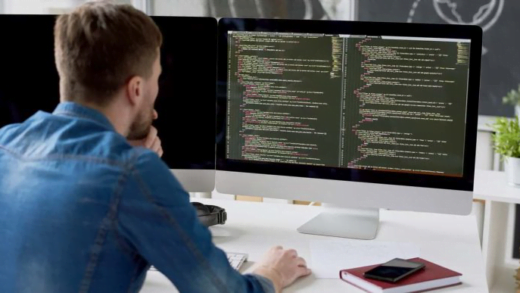

New businesses have been popping up left and right in recent years, prompting immense growth in the startup landscape. Data from Statista revealed that there were 1.1 million businesses that were less than a year old established by March 2022 in the United States alone. If you’re one of the many starting a business for the first time, there are many hurdles you’ll have to overcome to succeed. Proper financial management can help you stay afloat and thrive, whether dealing with your budget, revenue, or payroll. Managing your money can help sustain your new business amid the challenges, but it’s tough to deal with through human effort alone. There are many platforms out there to guide you through financial management. Here are three financial tools to supercharge your first business:

Financial planning and budgeting software

Budgeting your expenditures is paramount to the success of your new business. Creating and sticking to a solid and realistic budget or financial plan can help ensure that all your funds are directed to the necessary avenues to avoid hiccups and major issues with your money. Financial planning platforms like Vena can equip you and your team with comprehensive tools and solutions to streamline budgeting for your business. It utilizes the familiar format of Microsoft Excel spreadsheets and integrates it with AI-powered insights to help business, finance, and operations leaders make informed business decisions. Its automation capabilities automatically handle planning or reporting tasks for users, and its cloud-based model allows you to access data from anywhere. Budgeting and financial software can make it easier for everyone on your team to know where your money is going and if it’s sustainable enough to keep your business running well.

Revenue management software

Revenue is one of the most essential parts of any business, but managing it can consist of repetitive, complex, or time-consuming tasks that can take time away from core business activities. A revenue management system helps streamline your back-office functionality, enabling you to handle order management, billing, renewal management, and revenue recognition all in one place. SOFTRAX provides revenue management solutions that comply with new accounting standards, such as ASC 606 and IFRS 15, while supporting complex billing and revenue recognition in all forms. It helps automate even the most complex accounting procedures, paving the way for continuous accounting. A revenue management system can reduce the time and effort spent managing billing and revenue recognition so you and your team can focus on increasing revenue.

Payroll management software

Your employees are the heart and soul of your business and deserve to be paid fairly and on time. Manually managing payroll can be time-consuming and prone to error, and taking too long to process it can lead to dissatisfied staff. A payroll management system can help you efficiently and accurately calculate employee salaries, taxes, deductions, benefits, and more, saving you time and effort. Payroll management software such as Rippling offers an abundance of features and add-ons for easy payroll management but it is still easy to use and understand for new users, so it’s easy to start running it. It’s a flexible and customizable platform, enabling you to set it up for your business’s unique needs. Rippling also helped raise funding when the Silicon Valley Bank collapsed in early 2023, assisting customers to facilitate payroll amid the crisis. Using a stable and reliable platform that cares for its clients can ensure your employees get their salaries on time and without issue.

As a first-time business owner, dealing with all the ins and outs of running a company can be daunting. As highlighted in the previous “The Beginner Syndrome” post, you may feel a sense of impostor syndrome, feeling like you don’t belong in the industry or are doing everything wrong. It’s not easy to get over the beginner stage, but with the help of these financial tools, you can boost your business and make your way to success.

Visit the Wisdom Geek website for tips, insights, and guidance on tech, business, and life.