Investing is a popular way to grow your finances, but it can be a challenging venture to learn as investments can go both up and down depending on the market. There is always a risk when making any investment, and how much you put in may not always be how much you get back if the investment you choose falls in value and doesn’t recover. However, the risk of investments is part of why it is so popular, as the growth returns you can achieve when the investment goes up can be significant. While there are no guarantees when you’re investing your money, there are ways to maximise the potential returns and make more from the investments you choose to make. Keep reading to learn more.

Consider Your Goals

The first step when you’re looking to make the most of your money is to consider your goals. Are you saving for retirement? Did you want to save for a luxury holiday? Or are you simply looking to maximise your earnings in order to invest more? If you’re investing for the sake of it, you may find it harder to get the most out of your money, as a goal will help you choose your investments and where you want to put your money more wisely.

If you’re not sure why you want to begin investing, consider sitting down and writing a list of all the reasons this venture appeals to you and what you would do with the returns on your investments. By taking the time to think about it, you will find plenty of reasons you can turn into goals to help focus your investment efforts more clearly.

Plan When To Buy

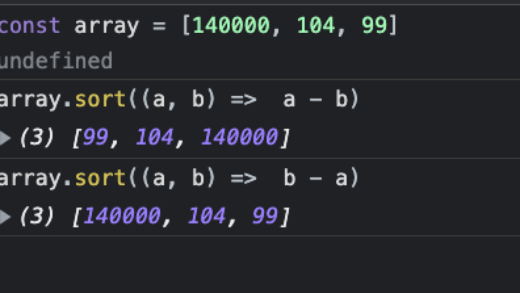

Once you understand your goals, planning when you invest is the next essential step in maximising your returns. By investing when the prices are low or when there is significant momentum, you can sell them at a later date for a larger profit. This is called a price action strategy, and there are two ways to do this.

The first is to take part in “Value Investing“, which is where stocks are trading for less than their book or intrinsic value, and this typically happens when the market overreacts to current news, leading to the stocks of a company not corresponding with their long-term fundamentals. These stocks are often considered “on-sale” or discounted by experienced investors who wait for stocks to drop below what they deem they should be valued at in response to bad news in the industry or good news about a direct competitor.

The other is momentum trading, and with this type of investing, you would choose to purchase stocks with prices that are currently on an upward trend, as the momentum is likely to keep going until you can sell for a profit. For this type of investing, you would need to have patience for the rising price of the stock you chose as the best time to sell would be once it’s reached its peak; however, this can be stressful as many investors fret about the price dropping suddenly when waiting for a stock to hit its peak to sell. In most cases, the momentum will keep going for a number of years, providing you with a long-term investment that will keep on giving until it reaches its peak.

Diversify Your Investments

Choosing to put your funds into only one type of investment is restricting and can leave you open to more risk if the markets experience volatile changes unexpectedly. By diversifying your investments, you will be able to minimise the risk to your portfolio, as when one investment is impacted by market changes, the others will hold steady. There are many ways you can diversify your investment portfolios, such as investing in stock and mutual funds or taking advantage of tax-efficient EIS investment opportunities.

For example, investing in EIS schemes offers exposure to growing British companies while offering attractive potential tax reliefs in return for your investment. An EIS investment is a good way to diversify your portfolio while not only having the potential for significant return but also helping to grow British enterprises. And to learn more about this scheme, visit Oxford Capital.

Remember, Investments Are Long Term

The most important thing to remember about investments is that they are not “get rich quick schemes”, which as a high-earning professional, shouldn’t be a concern. However, even high earners have made the mistake of thinking they will see more from their investments in the short term. Investments are for the long term, and very few investments will see a growth return in the first year, even with momentum trading. Once you get started, you may find yourself excited to see the growth, but you need to be patient and remind yourself that investments are for the long haul.